NEWS

2016 3rd quarter business performance figures indicated in this press release may vary in the audit and review conducted by the outside auditors as their audit or review has not yet been completed. These figures are _ base_d on the K-IFRS consolidated financial statements. Your understanding is solicited as they differ from the operating income amount previously disclosed, as they are now _ base_d on the operating income reflecting amendments concerning K-IFRS No. 1001 ‘Presentation of Financial Statements’.

● SKC posted 586.5 billion won in sales and 18.3 billion won of operating income (3.1% operating income ratio) following completion of restructuring efforts by SKC and its subsidiaries after steady implementation since 2015.

● Operating income decreased by 66.5% from the same period of the preceding year and net loss posted due to enhancement of HR structure efficiency of film business and temporary expenses incurred by sale of photovoltaic business.

● SKC declares New Vision[1] on its 40th anniversary and plans to actively pursue innovation of its management infrastructure, reform its core business structure, and secure growth potential through restructuring and growth of specialty product lines.

[Chemical business]

ㅁ Chemical line posts 179.5 billion won in sales, 26.5 billion won in operating income in 3rd quarter

- Line posts 179.5 billion won in sales, 26.5 billion won in operating income despite the slow demand for PG and Polyol, while a price hike was delayed in preparation for a price hike of propylene, a raw material of PO.

- Favorable business conditions are likely to be d with the growing demand for PG as the downstream industries enter a period of high demand, while PO prices will rise since the operating rate of competing produced in the relevant region, including China, though periodic repair is expected in the 4th quarter.

- The company plans to actively explore highly functional PU specialty materials markets while diversifying customers in downstream PO markets around PG and Polyol in order to boost the sales and profitability of the chemical line.

[Film business]

ㅁ 3rd quarter sales of 162.6 billion won, operating income of △19.7 billion won

- The film line posted 162.6 billion won and △19.7 operating income, reflecting the restructuring expenses of the film business to overcome the continued slow business of the key downstream industries, including mobile and display appliances.

- It is expected that the film line will see improved profitability as its expense structure has been optimized following the completion of its restructuring. The company plans to continue implementing its strategies for enhancing the competitiveness of its film line by developing strategic products, upgrading its product portfolio, commercializing high value-added highly functional future growth products (transparent PI film, TAC substitute film, PVB etc.) early on, and innovating productivity and costs.

[Subsidiaries]

ㅁ 244.4 billion won in sales, 11.5 billion won in operating income in 3rd quarter

- SKC’s subsidiaries posted 244.4 billion won in aggregate sales, a 20% increase over the same period of the preceding year, and 11.5 billion won in aggregate operating income, representing a fivefold increase year on year, as the group discontinued the SKC Solmics photovoltaic line due to repeated losses over a number of years.

- SKC posted operating income in excess of 10.0 billion won following growth in the 2nd quarter as a result of restructuring of its subsidiaries in 2015, and has secured the basis for improved profitability by selling off the SKC Solmics photovoltaic line.

- The company’s subsidiaries plan to concentrate on the profitability-oriented growth of Beauty & Healthcare (BHC) and semiconductor materials products. They participated in a 40 billion won capital increase with consideration in order to improve the financial structure of SKC Solmics and enhance the competitiveness of their semiconductor materials lines.

Note 1. Comparison of quarterly performance _ base_d on consolidated financial statements

(unit: 0.1 billion won, %)

Note 2. Quarterly performance by business line

(Unit: 0.1 billion won)

Note 3. SKC chemical business growth strategy

1. Growth of downstream PO customers

The chemical line plans to “strengthen its downstream business” in a drive to achieve “stable growth _ base_d on steady high profitability.”

1) PG line extension, 2) Gradual commercialization of specialty PU products, 3) win-win growth with MCNS

2. PU specialty products

SKC plans to enter the markets for highly functional PU specialty products currently monopolized by global p s, by utilizing the tangible and intangible assets - including PU technology, experience and customer networking - of the chemical business line.

Note 4. SKC strategy for growth of semiconductor materials line

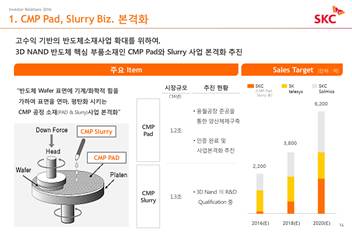

1. Active promotion of CMP pad and Slurry business

SKC is actively promoting CMP pad and slurry, core materials of 3D and NAND semiconductor parts to establish a highly profitable semiconductor materials business.

----------------------------------------------------------------------------------------------

[1] SKC New Vision: “Global Specialty MARKETER” (a global materials company focusing on specialty materials).