NEWS

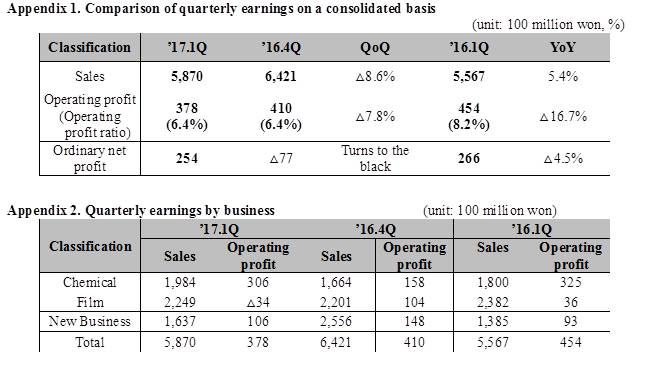

SKC posts 1Q sales of 587 billion won, operating profit of 37.8 billion won, and ordinary net profit of 25.4 billion won

The earnings of 2017’s first quarter suggested in this report are subject to change during the auditing/review process of external auditors as auditing by the external auditors has not been completed. This report uses figures compiled _ base_d on K-IFRS consolidated financial statements; has been drafted _ base_d on operating profit reflecting the amendments to K-IFRS’s No. 1001 'Financial Statement Presentation'; and provides operating profit figures that are different from those that were publicly disclosed previously. We ask for your understanding.

Despite unfavorable conditions, including low seasonal demand, a continued rise in raw material prices, and delays in sale-price hikes, sales rose 5.5% year-on-year to 587 billion won, but operating profit fell 16.7% year-on-year (from 45.4 billion won) to 37.8 billion won.

Aiming to take a leap forward to become a 'Global Specialty Marker', SKC will preemptively respond to customers' needs and those of the market. Furthermore, SKC will proactively seek to change its business model (value chain redesign, enhancement of product mix) to construct a stable profitability _ base_, and thereby focus on maximizing corporate value and accelerating growth.

The company will continue to implement shareholder return policies, such as stable payments of dividends and possible share buybacks, and provide guidance on next quarter’s sales (610 billion won) and operating profit (40–45 billion won) to dispel uncertainties among shareholders and in the market.

[Chemical Business]

ㅁ Sales of 198.4 billion won, operating profit of 30.6 billion won, and operating profit ratio of 15.4% in Q1

- Chemical business posted solid earnings due to process optimization, innovation of technology for propylene oxide (PO) production, and increased sales of high value-added propylene glycol (PG) to large global customers despite continuously strong oil prices and key raw material prices (achieved record quarterly PO production, and maximum PG sales for a low demand season).

- Q2 operating profits will likely increase due to transition into peak demand season, favorable PO supply and demand conditions, reflection of raw material price hikes in sale prices, and expansion of high-margin PG exports.

- The company plans to advance a business model centered on specialty materials by widely promoting the three areas—elastomers, functional adhesives, and lightweight materials—that the company selected by reflecting on its accumulated polyurethane (PU) business capabilities as well as future trends. Going forward, SKC will also continue to grow as a global PU leader by developing eco-friendly products that meet customer needs and by expanding its global system house.

[Film Business]

ㅁ Sales of 224.9 billion won and operating profit of 3.4 billion won in Q1

- The company incurred an operating loss of 3.4 billion won due to sluggish earnings of consolidated subsidiaries (SKC Inc.), in addition to external factors, such as rapid price hikes of key raw materials (TPA, EG), a low demand season, and intensifying competition in the solar market.

- The company plans to lay the foundation to increase sales and improve profitability by raising the price of PET film, strengthening competitiveness of subsidiaries SKC Inc. and SKC Jiangsu and expanding their value chains, and implementing strategy to speed up commercialization of high value-added products and different types of materials.

- With the acquisition of SKC Haas, SKC’s Film Business has established an integrated production system ranging from _ base_ film manufacturing to processing. Going forward, it will focus on improving profitability, securing core competitiveness, and enhancing value. This will be accomplished through strategic alliances with global buyers and companies with advanced technology centered in China, and by concentrating on high value-added and high-function products _ base_d on synergistic effects from integration with SKC Haas.

[New Business]

ㅁ Sales of 163.7 billion won, operating profit of 10.6 billion won, operating profit ratio of 6.5% in Q1

- Sales (138.3 billion won) and operating profit (9.3 billion won) in New Business increased year-on-year due to the establishment of New Biz-related businesses (semiconductor materials, magnetic materials, and BHC[1] materials), the emerging trend of expanding sales in the semiconductor materials business, early recovery from a sales slump due to the THAAD controversy in China, and a rise in earnest of the wireless charging material business.

- In the semiconductor material business, CMP materials segment is in the phase of entering a new market and the company is working to secure a product lineup. Meanwhile, the BHC segment is expected to see expanding growth centered on SK Bioland's new businesses, such as food supplements, medical devices, and mask packs. The magnetic materials business is in the process of expanding applications to wireless charging models in Korea and overseas ahead of takeoff in earnest of the wireless charging material business.

- In order to secure growth potential and competiveness of its New Business, SKC plans to aggressively make investments and seek mergers and acquisitions of companies with excellent competence in related businesses.

------------------------------

[1] Beauty & Health Care (BHC)