NEWS

● Company posted sales of KRW 638.7 billion and operating income of KRW 41.2 billion in Q1, while debt ratio declined to 128.4%

● Company also posted pre-tax profit of KRW 58.5 billion, representing an increase of 59.0% over the same period of the preceding year, thanks to the improved performances of its equity invested companies which are subject to equity method _ _ eval__uation.

SKC (CEO Wanjae Lee) posted sales of KRW 638.7 billion and operating income of KRW 41.2 billion in Q1 2018, representing an increase of 8.8% and 9.0% respectively over the first quarter of last year. The company also posted a pre-tax profit of KRW 58.5 billion, an increase of 59.0% over the same period of the preceding year, thanks to the improved performance of its key invested companies, including MCNS and SKC-Kolon Polyimide Inc. As a result, the company’s debt ratio has declined to 128.4% compared to the previous year, although it has invested heavily in its new transparent PI film equipment and semiconductor chemicals joint ventures in China.

SKC disclosed its 2018 Q1 performance figures at the home office of SKC Securities on May 3rd at a meeting attended by the executives responsible for its business units, including Yongseon Lee, head of the Industrial Raw Materials Division, Jihyeop Jang, head of the PO/POD Division, Seonghyeon Pee, head of the Management Support Division, and Yeongju Noh, head of the Value Innovation Support Office.

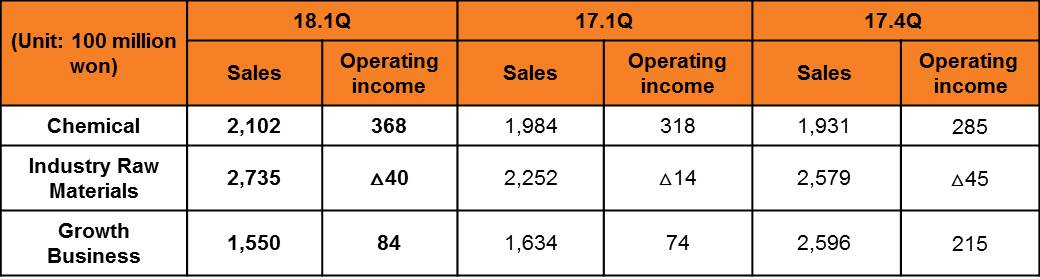

<SKC’s performance in 2018 Q1 (_ base_d on consolidated financial statements)>

The Chemicals Business posted sales of KRW 210.2 billion and operating income of KRW 36.8 billion thanks to improved profitability _ base_d on the growth of its high value-added business lines

Looking at the figures by division, the Chemicals Division posted sales of KRW 210.2 billion and operating income of KRW 36.8 billion. This is primarily attributable to the increase in production volume after the completion of temporary repair work late last year, while the production volume of high value-added products increased with the growth of high value-added downstream industries.

It appears that the currently favorable demand and supply conditions will continue into the second quarter because the supply will be limited by periodic repairs of major producers in the region. SKC plans to maintain its stable profitability by steadily increasing sales of its high value-added products, while simultaneously optimizing its production processes in order to enhance productivity and reduce production costs.

Industrial Raw Materials Business experienced reduced demand and cost hike ... likely to recover in Q2

The Industrial Raw Materials Business posted sales of KRW 273.5 billion and an operating loss of KRW 4 billion, as it was significantly affected by sluggish demand in the display and other downstream industries, while the price of raw materials rose. The price of TPA and EG, raw materials of film, rose by 12.3% and 15.4%, respectively, while demand in downstream industries slowed, causing twice as much hardship for the business. However, SKC Hi-Tech & Marketing - acquired as a subsidiary July of last year - posted sales of KRW 80 billion and operating income of KRW 2.3 billion in Q1 2018, representing a significant improvement over the KRW 62.8 billion in sales and KRW 5.0 billion operating loss posted in the same period last year.

Its performance looks set to further improve in the second quarter as it plans to intensify its efforts to reflect the increased cost factors in its product prices. The external environment also is favorable. The demand for heat-shrink film will increase for PET bottle label sleeves in the coming summer season when more bottled beverages are consumed. In addition, the demand for downstream industries will also increase for display film and highly functional release film as new mobile products will be launched and the Russia World Cup will be held in June. SKC Hi-tech & Marketing producing shatter-proof GDF film for the rear plate of mobile appliances will continue active business trends.

SKC is currently diversifying into high value-added specialty products such as SKC’s Ecolabel sleeves for PET bottles, for which SKC Inc., a US subsidiary, has already started a full-scale marketing campaign. SKC Ecolabels are environmentally-friendly, heat-shrink film sleeves for PET bottles that do not need to be removed when recycling PET bottles. As a result of these enhanced efforts, the ratio of the company’s high value-added specialty products increased from 22% in 2016 to 27% in 2017, and it now plans to increase the ratio to 32% this year and to 40% by 2020.

Growth business lines increased operating income over the same period of the preceding year... Sales will also increase in Q2

The growth business lines posted sales of KRW 155 billion and operating income of KRW 8.4 billion largely because it was a slack season for network equipment. Operating income increased by 13.5% over the same period of the preceding year due to active sales of semicon chip materials. The semiconductor chip materials line posted sales of KRW 70.8 billion and operating income of 3.7 billion, each showing an increase over the same period of the preceding year.

Its performance is expected to further improve in Q2. The Growth Business Division plans to start supplying CMP pads to global semiconductor chip producers upon completing its preparations for mass production by the second quarter. SK Telesys’ sales of network equipment are expected to recover growth from the second quarter. SKC Solmix will start the commercial operation of its newly invested semicon chip materials lines in the third quarter. In particular, SKC has organized a task force team for semicon chip materials, parts and equipment together with SKC Solmix and SKC Telesys, with the aim of enhancing the synergy effect by sharing their marketing infrastructure while exploring new business lines and customers.

The forecast for the BHC materials line is also rather promising. SK Bioland will start the commercial operation of the new factory it has built in China to produce third-generation mask packs in the second quarter. With a production capacity of 50 million units per year, it aims to sell 10 million units in the latter half of this year. It also expects the cosmetics materials line to grow; and is examining plans to extend its factory in Haimen, China, in order to extract natural materials for cosmetics.

“It appears our performance will gradually improve this year because the Industrial Materials business line will enter the peak demand season in the second quarter, while the key business lines will continue pursuing active business to increase their earnings,” said Yeongju Noh, head of SKC’s Value Innovation Support Office. “We should be able to post operating income of around KRW 200-20 billion and consolidated operating income of around KRW 335 to 365 billion throughout the year, including the operating income of the equity-invested companies.” [End]