NEWS

● New vision of ‘Global Specialty MARKETER’ realized by increasing access points with end users

● Deployment of integrated production system from film making to processing··· Completion of film business ‘value chain’

SKC recently announced that it has taken over 51% of the equity shares of SKC Haas Display Film, a company specializing in film making and processing, from Dow Chemical, a comprehensive chemical producer _ base_d in the USA. SKC’s board of directors concluded the deal on the 16th. The equity shares are worth 81.7 billion won in total. SKC, which previously held 49% of SKC Haas, will own 100% of the company upon completion of the acquisition procedure. SKC plans to actively grow its film processing business as a new growth engine by completing the acquisition from Dow Chemical by this coming June.

SKC Haas, Korea’s No. 1 film processing and seller company, was established in 2007 as a JVC between SKC and Rohm & Haas (acquired by Dow Chemical in 2009). It operates production facilities in Cheonan in Korea and Suzhou in China, and produces 64% of the world’s Shatter Proof Film, while its optical OCA film technology is widely recognized as the world No. 1.

Its key products include ▲shatterproof film that prevents glass from shattering, and features improved design functions; ▲silicone release film for THE OCA process; ▲Mill _ base_, raw materials for LCD/OLED color filter; and ▲shatterproof reflective film used for display BLUs. The company posted 277.8 billion won in sales and 13.1 billion won in net profit in 2016.

(Estimated by SKC Haas)

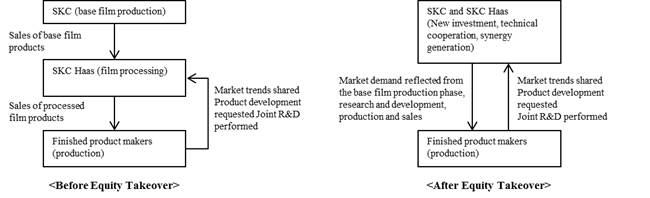

SKC made the decision to acquire SKC Haas equity shares as it believed significant synergy could be achieved by adding SKC Haas’ film processing business to its existing film making business. On its 40th anniversary, SKC declared its new vision as a ‘Global Specialty MARKETER,’ revealing its determination to grow into a global business by developing technology-intensive products that satisfy the market requirements. The current acquisition is _ base_d on this strategy.

The acquisition will have the following effects: upon its completion, ▲SKC will be able to increase its film processing business as the restriction imposed on investment in film processing at the time of SKC Haas’ founding will be removed. ▲SKC also believes it will be able to provide products that satisfy customer requirements by rapidly capturing market demand, while increasing the access points with end-users. ▲SKC also expects to enhance its competitiveness through integrated management of the value chain - from film making to processing – ▲as well as to strengthen its foundation for global diversification.

Henceforth, SKC will be able to develop and commercialize diverse new film products as the restriction imposed on investment in film processing is due to be removed. Previously SKC was unable to actively invest in its film processing business due to the imposition of a non-competition clause at the time of SKC Haas JVC’s founding in 2007. Once it has taken over SKC Haas’ equity, SKC will be liberated from the investment restriction.

In addition, SKC will be able to increase the number of access points with its end users. It is striving to increase the access points with end-user customers by supplying film products to intermediary vendors. The company will be able to launch new products that further satisfy customer requirements in a timely fashion by quickly capturing the market trend. This move is ed to particular emphasis on the concept of “Marketer” in its new vision of ‘Global Specialty MARKETER’ in a drive to fully meet all the requirements of its customers and markets.

SKC believes it will be able to rapidly develop new products demanded by the markets if it incorporates customer requirements from the _ base_ film production stage, while business efficiency will be further enhanced if research and development are conducted jointly with the producers of finished product products. SKC Haas has already performed R&D jointly with many global leaders.

SKC aims to complete the value chain from film production to processing, and believes its overall competitiveness will be enhanced if SKC Haas’ processing technologies are added to SKC’s own film production and R&D capabilities. SKC Haas’ processing technologies will be used to develop high-tech specialty products under development by SKC, including transparent PI film.

In addition, SKC will be able to augment its global growth _ base_ centered on China. SKC plans to communicate directly with its customers in China by making its factory in Suzhou, China the _ base_ for its film processing business, while generating synergy effects with its film factory in Jiangxi, China, in a bid to explore potential customers while ly responding to diverse customer requests.

SKC plans to enhance the processing technologies of SKC Haas to the global leader level in order to maximize the synergy effect. It also plans to actively advance into diverse markets for semiconductors and smart cars while speedily accommodating the requirements of the next-generation mobile and display market customers, including the processing of flexible display materials and enhanced color representation products.

“SKC recognized the importance of film processing and as a result began its processing business by developing the world’s fourth video tape in 1980, after developing PET film for the first time in Korea in 1977,” said one SKC executive. “SKC will make diverse efforts to fully demonstrate SKC Haas’ technological competence, including the reinforcement of its facilities and the expansion of its customer _ base_ into the global market. [End]

Photo: