NEWS

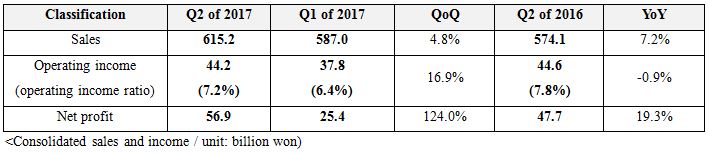

● 615.2 billion won in sales and 44.2 billion won in operating income posted, attaining the upper end of the 2nd quarter forecast presented in its Q1 earnings announcement

● 650 ~ 700 billion won in sales and 47 ~ 52 billion won in operating income presented as targets for Q3

SKC recorded sales of 615.2 billion won and operating income of 44.2 billion won despite unfavorable market conditions, including growth rate slowing down while competition intensified in key markets. Compared with the first quarter performance, sales and operating income increased 4.8% and 16.9%, respectively. Sales increased 7.2% from the 574.1 billion won posted in the same period last year, but operating income remained at the 44.2 billion won level posted in the same period last year.

The current quarter’s figures are meaningful since they met the 2nd quarter guidance figures announced along with the 1st quarter performance figures. SKC has decided to publish its quarterly forecasts from this year -- in a rare move among local exchange listed companies -- in order to communicate with the market more actively. SKC has posted sales of 610 billion won and operating income of 40 ~ 45 billion won, meeting its targets for the 2nd quarter.

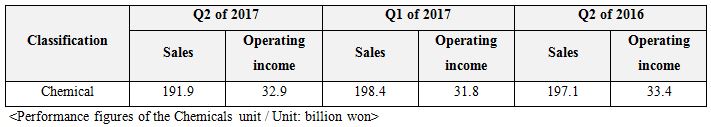

Chemicals unit posts 191.9 billion won in sales, 32.9 billion won in operating income, and operating income ratio of 17.1% for the 2nd quarter

The chemicals unit recorded 191.9 billion won in sales, 32.9 billion won in operating income, and operating income ratio of 17.1% for the 2nd quarter. The demand for Propylene Oxide (PO) decreased slightly in the 2nd quarter because of the slow growth rate of the Chinese market. Therefore, SKC made further efforts to ▲reflect the rising prices of raw materials on its product prices and ▲optimize its production processes by introducing innovative technologies for PO production under the favorable situation of “supply shortage” due to the periodic overhaul of production facilities of some competing companies. As a result, although operating income decreased from 32.9 billion won compared to the previous year, profitability actually improved to 17.1%.

Competition in the 3rd quarter is forecast to be intensified further by the growing supply volume alongside the operation of new PO and downstream production facilities in the region. Thus, SKC plans to increase its sales by strengthening cooperation with its customers of PU specialty materials, including those of ▲elastomer, ▲functional additives, and ▲lightweight materials, while steadily enhancing the competitiveness of its downstream products such as Propylene glycol (PG) and polyolefin Polyol.

MCNS, a joint venture with Mitsui Chemical, Japan, will recover its profitability in the 3rd quarter even though its performance slowed down temporarily because of the periodic overhaul of its TDI plant (toluene diamine - raw material of polyurethane). It is because plant overhaul will be completed while the strong TDI demand will continue.

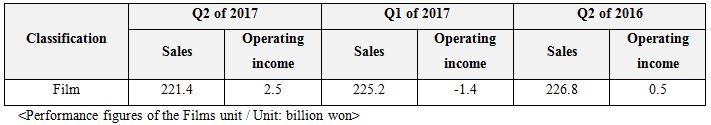

Films unit posts 221.4 billion won in sales, 2.5 billion won in operating income, and operating income ratio of 1.1% for the 2nd quarter

The films unit’s profitability improved. Operating income posted a positive figure as it increased from a minus figure of -1.4 billion won in the 1st quarter to 2.5 billion won in the 2nd quarter. It surpassed the operating income of 0.5 billion won in the same period last year. Such increased sales are attributable to the increase in sales of products related to solar panels and increase in PET (polyester) film price to reflect the prices of key raw materials (TPA, EG), which rose sharply in the 1st quarter.

The competition in the optical PET film market is forecast to remain fiercely competitive in the 3rd quarter as well. SKC plans to recover its profitability by increasing sales of high value-added specialty film products like high-quality Silicon Release film and solar panel-related products. In particular, SKC, Inc., whose performance was sluggish because of the intense competition in the USA market, is attempting to secure a competitive edge for its PET film in cooperation with companies equipped with advanced technologies. SKC Jiangsu, China will continue its improved performance in the 3rd quarter as well after posting better performance with improved product portfolio.

From the mid- and long-term perspectives, SKC plans to enhance its profitability by improving its production processes with smart factory facilities while rapidly introducing high-margin specialty products, including Polyvinyl-butyral (PVB) film. In particular, the company plans to enhance its sustainability by newly designing its value chain from its existing focus on “_ base_ film sales” to “film sales post-processing.” At the center stands SKC Hi-tech & Marketing, a subsidiary newly acquired in early July that processes (converts) films or materials.

SKC Hi-tech & Marketing, which merged with SKC’s film processing unit, plans to concentrate on diverse materials lines other than PET, such as products related to electric cars and semiconductors (IC chips), in order to strengthen its strategic products. It will enhance the competitiveness of its overall processing lines _ base_d on such plan.

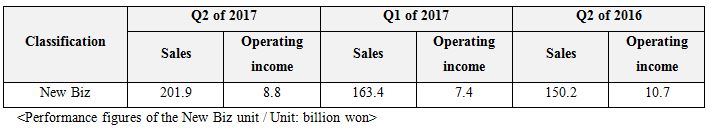

New Biz unit posts 201.9 billion won in sales, 8.8 billion won in operating income, and operating income ratio of 4.4% for the 2nd quarter

The New Biz unit, which is being promoted as a future growing engine, recorded 201.9 billion won in sales and 8.8 billion won in operating income in semiconductor materials, magnetic materials, and beauty and healthcare products. Such performance was attributed to its increased sales of semiconductor materials and parts in accordance with the growth trend of the global IC memory chip market. On the other hand, its beauty and healthcare materials line posted a temporarily sluggish performance due to seasonal weak demand and impact of the Chinese sanctions for the deployment of the THAAD missile defense system in South Korea.

In the 3rd quarter, the company plans to expand its markets to China and Taiwan while diversifying into the CMP materials lineup consisting of semiconductor-related products. The magnetic materials line that developed some next-generation materials in particular will actively promote its business related to differentiated wireless charging service while increasing sales by deploying a cooperative relationship with a global major smart phone company.

“We could attain our previously forecast figures with the growth of our semiconductor materials and parts lines while reflecting the rising prices of raw materials for film and chemical products, even though the conditions of key markets in China, USA etc., were far from favorable. We will do our best to achieve the target figures for the 3rd quarter as well, including forecast sales of 650 ~ 700 billion won and 47 ~ 52 billion won in operating income,” an SKC executive said.

Meanwhile, SKC was given the Best Accounting Transparency Prize after its level of information provision to the outside was assessed as superior by the Korea Accounting Society, including its ▲delivery of information through its website, ▲regular disclosure, and ▲ investor relations. “We plan to minimize uncertainty for our shareholders and the market by providing corporate information more justly and transparently from now on,” the SKC executive added. [End]