NEWS

Sales increase of 26.3% and operating profit increase of 163% YoY

Tangible performance attributed to the Deep Change strategy implemented for the new vision

Company expects sales of KRW 700~750 billion and operating profit of KRW 47~52 billion for the 4th quarter

Higher dividend than last year (_ base_d on market value dividend rates) planned to boost value for stockholders

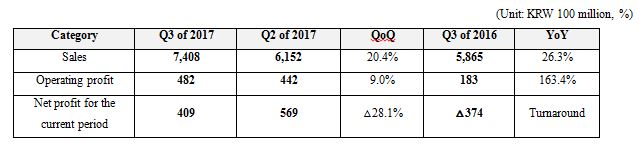

SKC (CEO Lee Wan-jae) posted sales of KRW 740.8 billion and operating profit of KRW 48.2 billion for the 3rd quarter of 2017, a great YoY leap compared to second quarter’s sales of KRW 586.5 billion and operating profit of KRW 18.3 billion. The market considers this to be one of the tangible results of the Deep Change engagement in which the company has put a lot of work. SKC announced its new vision dubbed “Global Specialty MARKETER,” and it has been engaged in efforts focusing on “Improvement of management efficiency to reinforce the competitiveness of core business,” “Innovation of Biz model with emphasis on specialties of high added value,” and “Establishment of organizational structure with focus on customers and market.”

The figures are even higher than the sales and operating profit of the preceding quarter by 20.4% and 9.0%, respectively. “Such performance is attributable to the sizable growth of film business and New Biz as well as improved profitability, and we have achieved the targets (sales of KRW 650~700 billion / operating profit of KRW 47~52 billion) set while announcing the results of the 2nd quarter," SKC commented.

3rd quarter performance of chemical division: Sales of KRW 202 billion and operating profit of KRW 33.1 billion

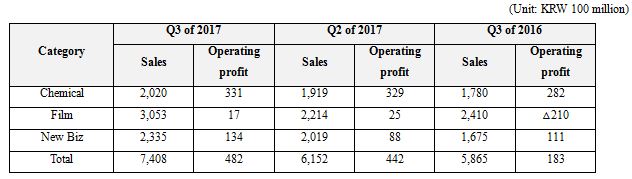

The chemical division saw solid performance, too, with sales of KRW 202 billion and operating profit of KRW 33.1 billion. In the face of unfavorable conditions such as increased prices of materials such as propylene due to increased oil prices, business growth owing to the boosted sales of major products such as polypropylene oxide (PO) and propylene glycol (PG) enabled the company to see improved YoY results of 13.5% in sales and 17.4% in operating profit as well as higher sales and operating profit by 5.3% and 0.6%, respectively, compared to the 2nd quarter.

The burden of maintaining the profitability of the chemical business is expected to be felt in the 4th quarter, caused by the handicap of increase of raw material cost due to the continued oil price hike. To overcome such handicaps, SKC plans to boost the productivity of PO, one of its main products, through temporary facility maintenance for applying new catalysts while constantly working to advance the competitiveness of downstream products of PO such as high-value PG, polyol (raw material of polyurethane), and specialty PU.

Meanwhile, MCNS, the joint company started together with Mitsui Chemicals of Japan in July 2015, saw considerably higher profits for the 3rd quarter. The company expects the current conditions for isocyanate to be maintained thanks to favorable market conditions for products such as TDI (toluene diamine, raw material of polyurethane) and isocyanate, along with the successful completion of regular maintenance of factories.

3rd quarter performance of film division: Sales of KRW 305.3 billion and operating profit of KRW 1.7 billion

The film division remains in the black after bouncing back in the 2nd quarter. The film business of SKC recorded operating loss of KRW 1.4 billion in the 1st quarter but posted operating profit of KRW 2.5 billion for the 2nd quarter. Such recovery is attributable to the optimization of cost structure and facilities thanks to efforts to boost management efficiency in the 2nd and 3rd quarters last year. Sales for the 3rd quarter stood at KRW 305.3 billion, which is a significant increase of 26.7% YoY and 37.9% compared to the previous quarter. The company attributes such rally to the consolidation with a new affiliate (SKC High Tech & Marketing), additional demand for optical films, and increase of unit sales prices _ base_d on the improved product mix.

Traditionally, the 4th quarter is a lean season for the film industry, and the business is expected to see some decline. Nonetheless, SKC plans to concentrate on high-value specialty products while strongly advancing overall business for better profit-loss structure following 2018.

3rd quarter performance of New Biz: Sales of KRW 233.5 billion and operating profit of KRW 13.4 billion

New Biz such as semiconductor materials, magnetic materials, and materials for beauty and healthcare industry, the future growth driver of SKC, appear to enjoy constant growth. Significant YoY growth of 39.4% in sales and 20.7% in operating profit was recorded, not to mention growth of 15.6% in sales and 52.3% in operating profit compared to the preceding quarter. Such growth was led by constantly improved performance of semiconductor materials and materials for the beauty and healthcare industry along with the maintained growth of frontline industries related to semiconductor materials. The growth of SKC Solmics is garnering attention as the company is focusing on semiconductor materials after shutting down the solar panel business last year.

The prospects of SKC’s new Biz appear bright in the 4th quarter, too. In particular, things seem to be looking bright for SKC as the THAAD-related issues from China, which held back the beauty and healthcare businesses, seem to be subsiding. Seasonal factors of the winter and boost of productivity mostly in China add to such bright prospects. SK Bioland, one of the highly regarded affiliates of SKC, is building a bio cellulose-_ base_d mask pack factory in Haimen, Jiangsu of China with completion targeted for the first half of next year.

The company aims to add great efforts to the globalization strategy with focus on China for the semiconductor material business. The “SKC 2nd Specialty Complex” to be built in Nantong, Jiangsu of China is expected to expand production facilities for semiconductor processes and CMP material lineup, and the company will work on aggressive penetration into the overall greater China region including Taiwan. In terms of its magnetic material business, SKC plans to increase sales by forging cooperative relations with a global major mobile device manufacturer as well as building differentiated wireless chargers.

SKC to achieve 4th quarter targets while constantly working to improve values for stockholders

For the 4th quarter, SKC is targeting sales of KRW 700~750 billion and operating profit of KRW 47~52 billion. This is not far from its 3rd quarter targets (sales of KRW 650~700 billion / operating profit of KRW 47~52 billion). “The estimates reflect the increased pre-tax profits thanks to valuation gain using the equity method for the companies that we invested in, such as MCNS and SKC Kolon PI, as well as the facility maintenance plan for the 4th quarter to improve the productivity of the chemical and film businesses. The figures also reflect the efforts to maintain the profit increase that started this year into 2018 and thereafter. Needless to say, efforts to boost stockholder values will continue by providing dividend similar to last year (KRW 750 per share, market value dividend rate of 2.3%)," said Kim Jong-u, chief of the BM (Biz. Model) Innovation Support Office of SKC.