NEWS

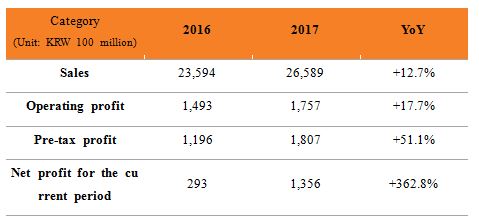

Sales of KRW 2.6589 trillion, operating profit of KRW 175.7 billion - YoY increase of 12.7% and 17.7%, respectively

Dividend per stock reaches KRW 900, which is 20% higher than last year for maximum value for stockholders

Future growth investment to be implemented at twice the size in 2016 for specialty-focused growth and accelerated innovation of business model

A report from SKC (CEO Lee Wan-jae) revealed that the company recorded sales of KRW 2.6589 trillion, operating profit of KRW 175.7 billion, and net income of KRW 135.6 billion. The figures represent YoY increases of 12.7%, 17.7%, and 362.8%, respectively. Pre-tax profits also posted a significant YoY boost from KRW 119.6 billion in 2016 to 180.7 billion, thanks to the outstanding performance of major investment partners such as MCNS and SKC Kolon PI.

Dividend per stock in 2017 has been set to KRW 900, which is a 20% YoY hike thanks to such solid growth. The company also decided to maintain the 2% cash dividend return rate to enable aggressive stockholder value.

The company announced these 2017 results before an audience that included Won Gi-don (General Business Operation Chief) and Lee Yong-sun (Chief of the Industry Materials Business) at the headquarters of SK Securities in Yeouido, Seoul on the 5th.

Last year, SKC managed to boost sales mainly from the industry material business and new growth business including, but not limited to, addition of SKC High Tech & Marketing and breakthrough growth of communication equipment and semiconductor parts. For future growth, the company also invested approximately KRW 220 billion or more than double its KRW 91.7 billion investment in 2016. This exceeds the KRW 200 billion they projected at the performance announcement back in February last year. Details of investment include purchase of shares of SKC High Tech & Marketing, investment for PU specialty in China, and upgrades of CMP pad-related facilities. Despite such aggressive investment, the debt ratio went down from 131.6% to 130.3% and interest coverage ratio improved from 3.5 to 3.8 times.

Chemical division: Sales of KRW 785.4 billion and operating profit of KRW 126.3 billion, new growth drive planned

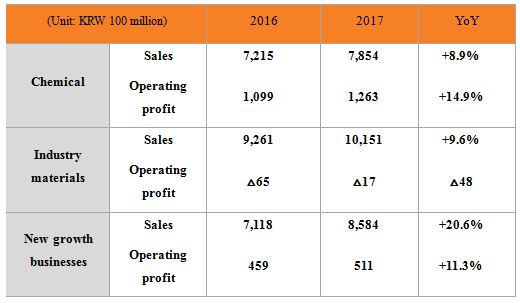

By individual business field, the chemical division recorded sales of KRW 785.4 billion and operating profit of KRW 126.3 billion. Amidst the increased cost and fiercer competition, the company's own efforts such as boosted sales quantity of high-value PG, cost reduction campaign, and preemptive response to regional price fluctuation resulted in improved performance compared to 2016. Sales increase rate was 8.9%, whereas operating profit posted a growth rate of 14.9%.

The company expects 2018 to be another year of solid performance. Local PO production quantity will exceed expected demands, but consumption is on a steady rise as the company expanded its own PG production capacity last year, which will also add to its own consumption of PO.

SKC is reviewing and discussing with multiple potential partners wishing to cooperate with the company regarding eco-friendly PO processes, to which the world is paying close attention. The company will determine the partner before year-end and make the decision to proceed with the business. This means that they will be armed with a new growth driver for the chemical business. They are also reviewing the idea of the world’s first introduction of independent production of DPG, one of the high-value PGs. Enjoying hugely popular demand for cosmetics and perfumes, DPG continues to face the problem insufficient supply as it accounts for only 10~15% of the total PG production.

Industry Materials Business: Sales of KRW 1.15 trillion and operating profit increase of KRW 1.7 billion, as a result of the shutdown of solar business in the US

The industry materials division in charge of the film business recorded sales of KRW 1.15 trillion, but operating profit increased to a mere KRW 1.7 billion, due mostly to the shutdown of the solar business in the US. With SKC headquarters in Korea posting operating profit of KRW 23.3 billion through the expanded sales of high-value specialty products such as heat-shrink film that the company sells the most locally as well as sheets for solar panels, SKC Jiangsu, the Chinese affiliate, started to be in the black. Note, however, that the cost from shutting down the solar panel business of SKC, Inc. in the US caused the negative figure overall.

The company expects the figures to bounce back in 2018 as the solar panel business in the US is completely closed. SKC headquarters is working on adding more specialty products such as composite film by cooperating with SKC High Tech & Marketing. The Jiangsu factory of China will endeavor to _ create_ more synergy by working with the Suzhou factory of SKC High Tech & Marketing. Meanwhile, SKC, Inc. aims to improve performance with a new business item.

Growth business office posts sales of KRW 858.4 billion and operating profit of KRW 51.1 billion, thanks to the reinforced business of semiconductor process materials

Involved in new projects such as semiconductor and beauty and healthcare (BHC), the growth business office recorded tangible results in semiconductor-related businesses, including sales of KRW 858.4 billion and operating profit of KRW 51.1 billion. They represent YoY growth of 20.6% and 11.3%, respectively. The growth of the semiconductor materials business is attributed to the stable development of global memory semiconductor markets.

For the semiconductor materials business this year, the company plans to reinforce the business of CMP materials for manufacturing processes and shore up businesses in China by completing the wet chemical JV manufacturing facility. SK Bioland, one of the affiliates of SKC, will complete the next-gen mask pack factory in China in the first half of this year.

SKC is also creating synergy among business divisions by establishing an overall business operation office as part of its organizational reform early this year. The company replaced the film division with the industry materials business division, whose focus shifted from PET films to functional specialty materials such as transparent PI film and PVB film. [End]